What if teenagers could invest in curated AI-advised portfolios and start growing wealth at an early age?

What if teenagers could invest in curated AI-advised portfolios and start growing wealth at an early age?

Copper Banking was in the space to help teenagers save money and achieve their goals. Our next big target was investing. A complex, well-regulated, and constantly changing environment. I led the product strategy and designed Copper Banking's first investing product for teenagers and their parents.

Copper Banking was in the space to help teenagers save money and achieve their goals. Our next big target was investing. A complex, well-regulated, and constantly changing environment. I led the product strategy and designed Copper Banking's first investing product for teenagers and their parents.

0-1 product launch

0-1 product launch

Product design

Product design

Product strategy

Product strategy

Usability testing

Usability testing

Finance

Finance

B2C

B2C

Cryptocurrency

Cryptocurrency

Company

Year

Roles

Company

Charles Schwab

Year

2021

Role

Product design leadership

Product strategy

Research synthesis

Cross-functional facilitation

Teens struggle to learn investing because it feels complex, risky, and disconnected from their real lives.

Teens struggle to learn investing because it feels complex, risky, and disconnected from their real lives.

When investing became an opportunity for our younger generation

When investing became an opportunity for our younger generation

Investing is inherently complex, especially for first-timers, and even more so for teenagers with limited experience and high risk aversion. At the same time, parents needed visibility and confidence that teen investing would be safe and educational.

Investing is inherently complex, especially for first-timers, and even more so for teenagers with limited experience and high risk aversion. At the same time, parents needed visibility and confidence that teen investing would be safe and educational.

Key problems areas

Complexity and confidence

Teens didn't understand investing and feared losing money.

Dual audiences

The product needed to feel approachable for teens and reassuring to parents.

Compliance and trust

The investing experience needed to be transparent and easy to understand.

I defined clear design goals to guide decision-making and shape product direction and priorities

Simplify decisions

Distill investing concepts into simple, actionable steps.

Build trust

Remove intimidating jargon and present concepts clearly for both teens and parents.

Drive adoption

Create an experience that encourages immediate engagement.

Testing different solutions revealed that providing an AI-advised portfolio significantly reduced anxiety for teenage investors.

Testing different solutions revealed that providing an AI-advised portfolio significantly reduced anxiety for teenage investors.

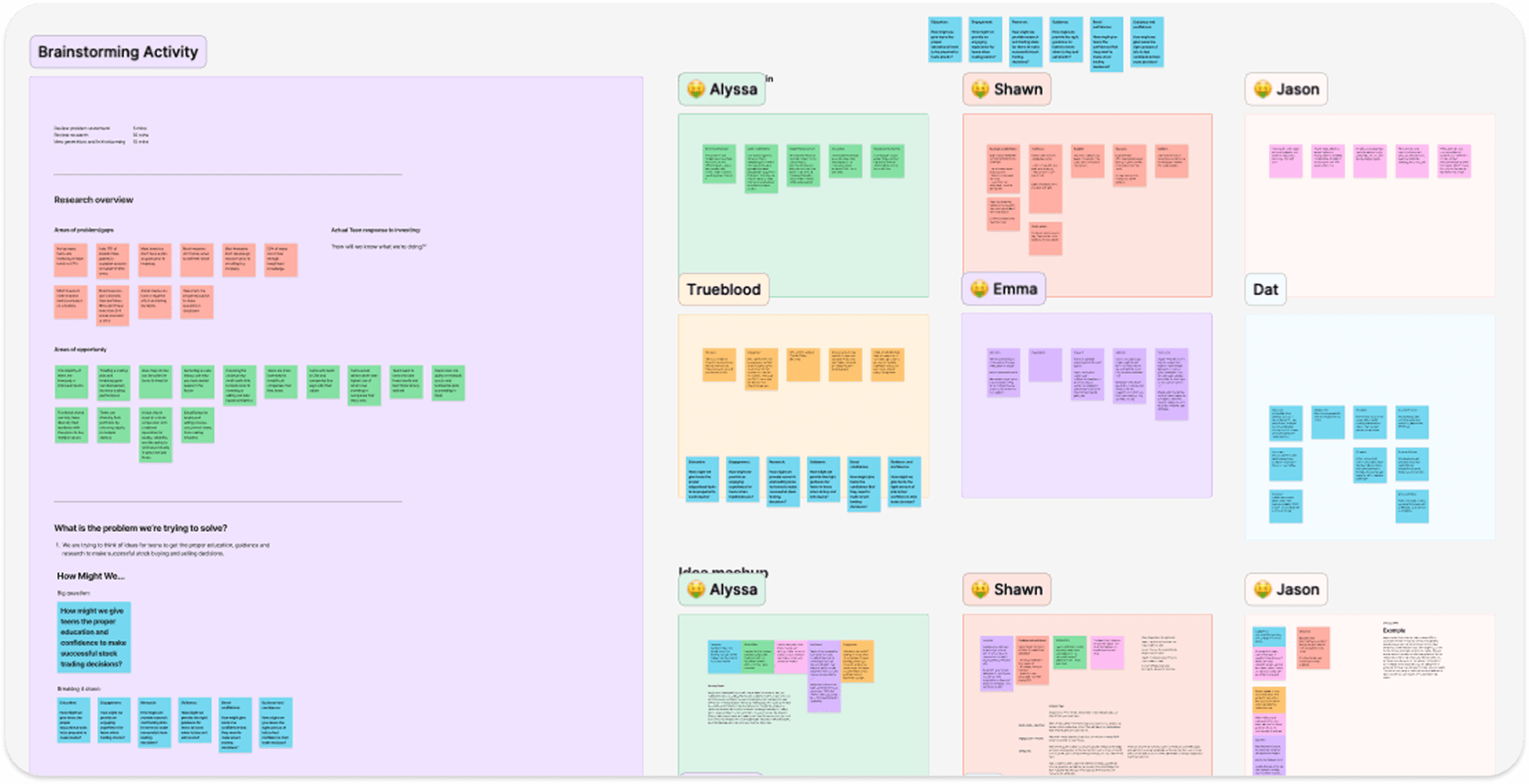

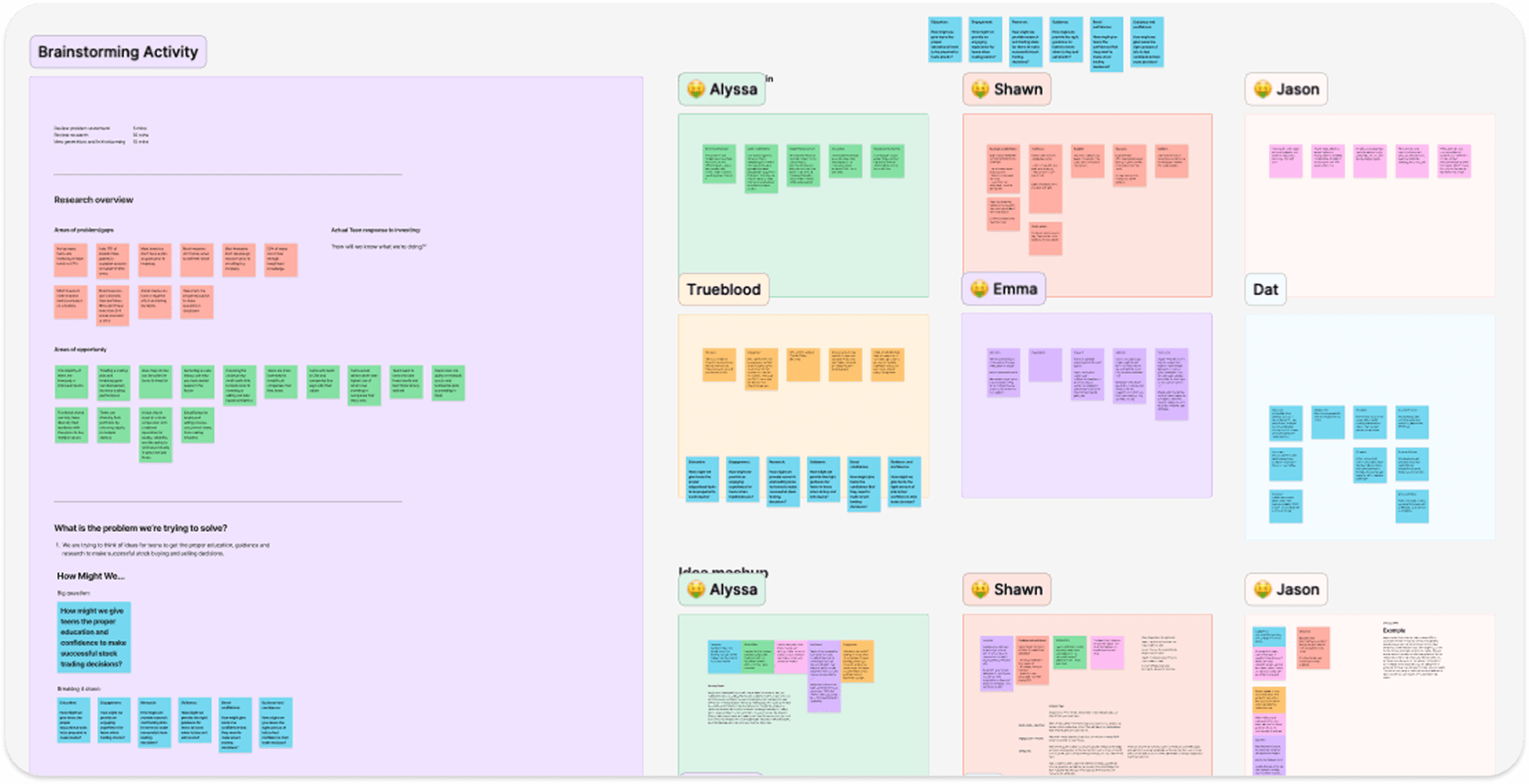

To inform the experience, I leveraged usability testing, interviews, persona development, and led several design thinking activities with my team:

Teens feared complexity and relied on guidance rather than choice overload.

Parents wanted transparency and control without micromanagement.

Both groups valued education embedded in action rather than separate tutorials.

These insights shaped every interaction and information hierarchy in the experience.

Figma prototypes were shared with teenagers and parents of and they were prompted to interact with the prototype as if they were creating their first investing account. Feedback was incorporated into design iterations as we dialed in the experience.

Testing different solutions revealed that providing an AI-advised portfolio significantly reduced anxiety for teenage investors.

To inform the experience, I leveraged usability testing, interviews, persona development, and led several design thinking activities with my team:

Teens feared complexity and relied on guidance rather than choice overload.

Parents wanted transparency and control without micromanagement.

Both groups valued education embedded in action rather than separate tutorials.

These insights shaped every interaction and information hierarchy in the experience.

Figma prototypes were shared with teenagers and parents of and they were prompted to interact with the prototype as if they were creating their first investing account. Feedback was incorporated into design iterations as we dialed in the experience.

Testing different solutions revealed that providing an AI-advised portfolio significantly reduced anxiety for teenage investors.

“I don’t even know what a portfolio is. Can it just pick for me?”

Levi C.

Teenage participant

Made education the focal point of the overall experience.

Made education the focal point of the overall experience.

Education was woven directly into the experience via bite-sized tips and clear explanations, making learning an integral part of action rather than a separate step.

Education was woven directly into the experience via bite-sized tips and clear explanations, making learning an integral part of action rather than a separate step.

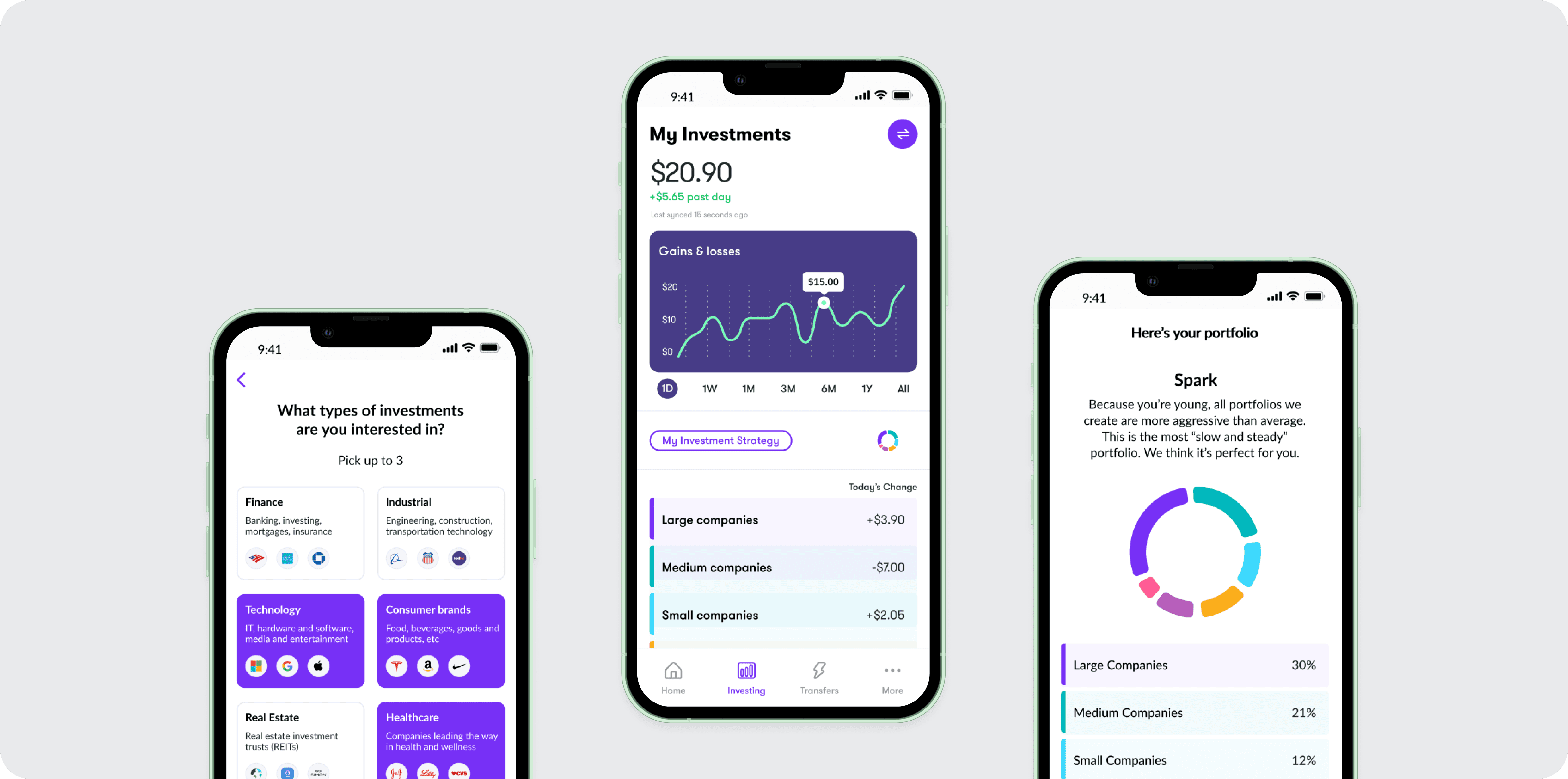

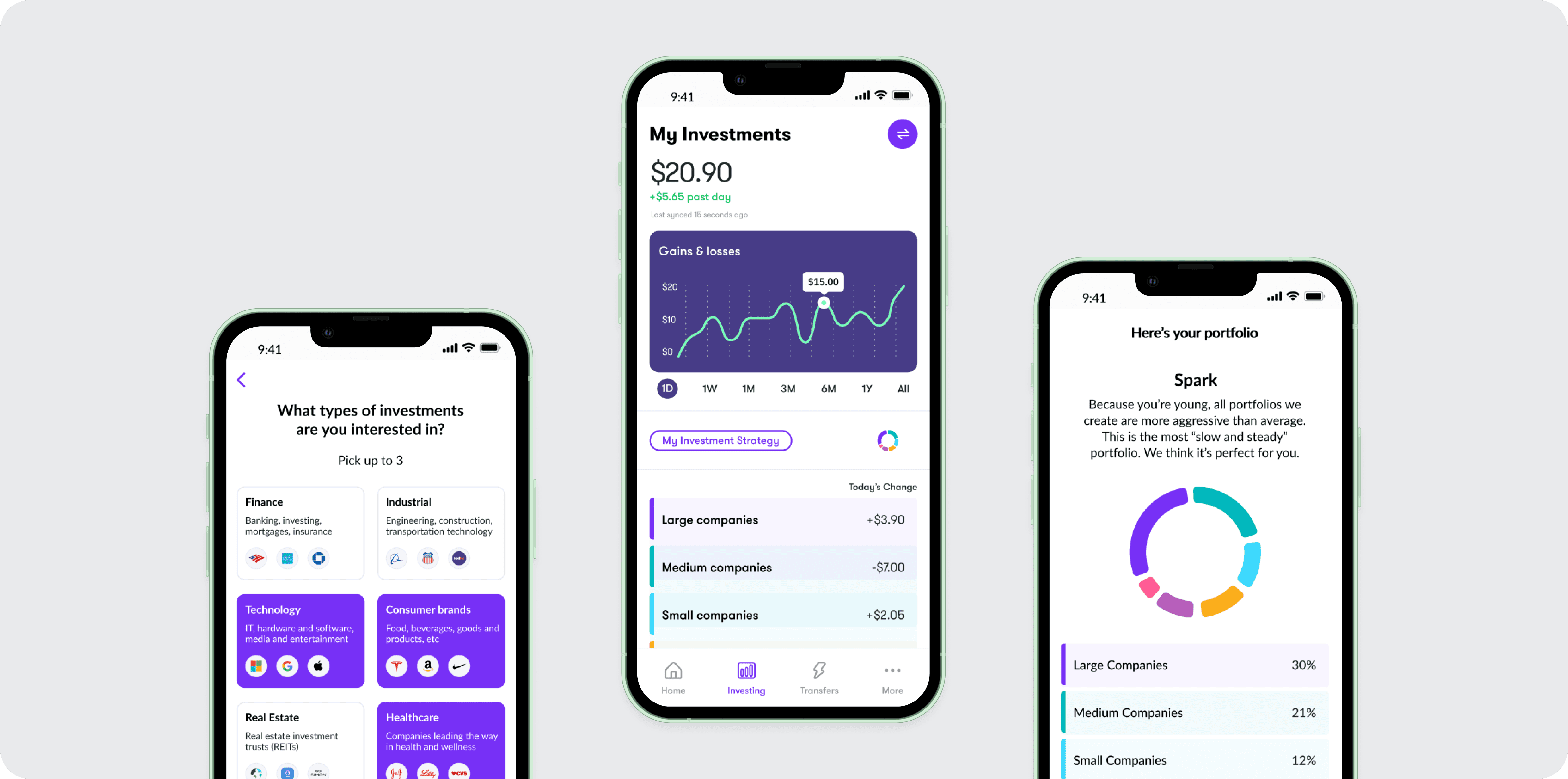

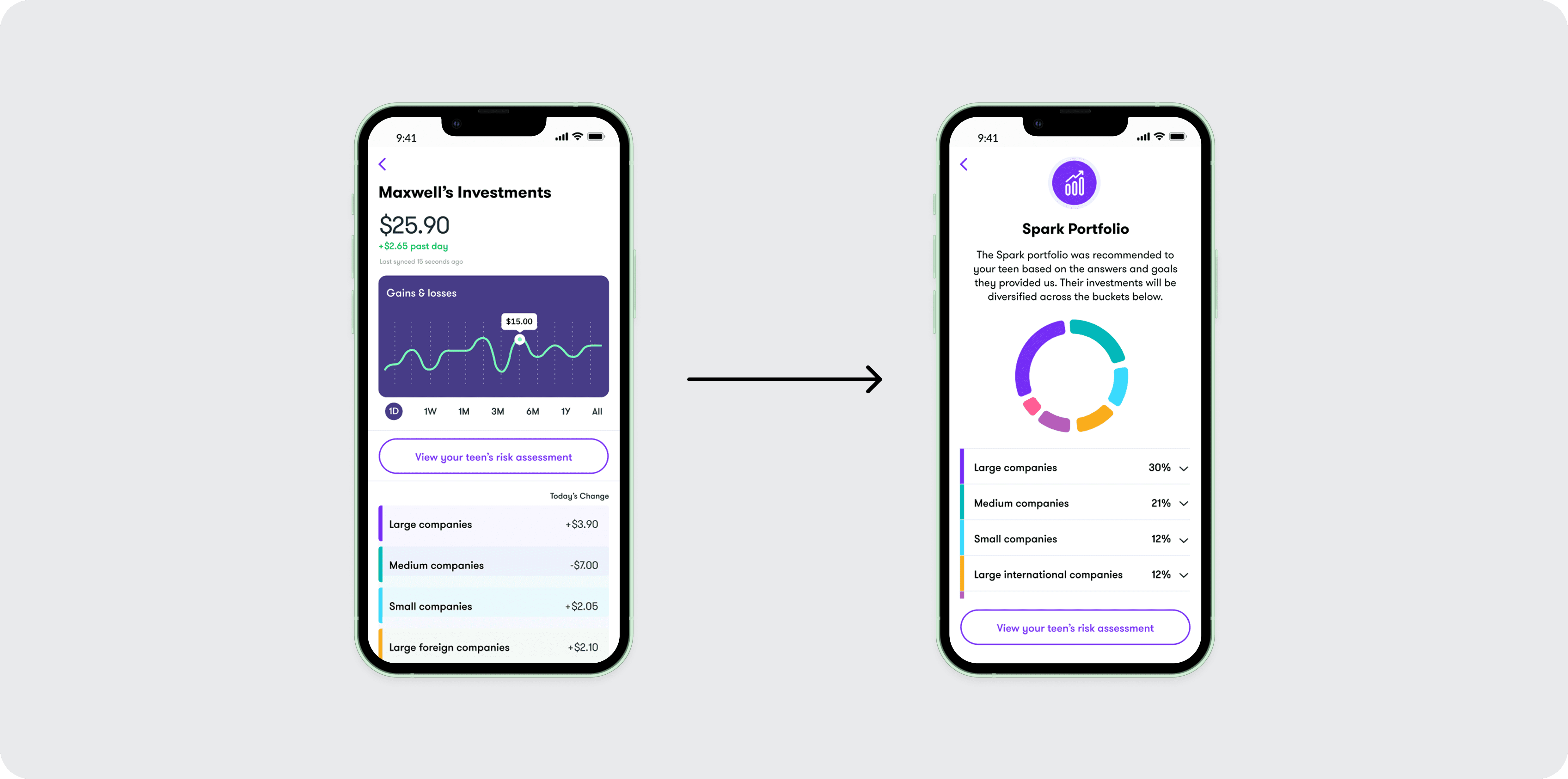

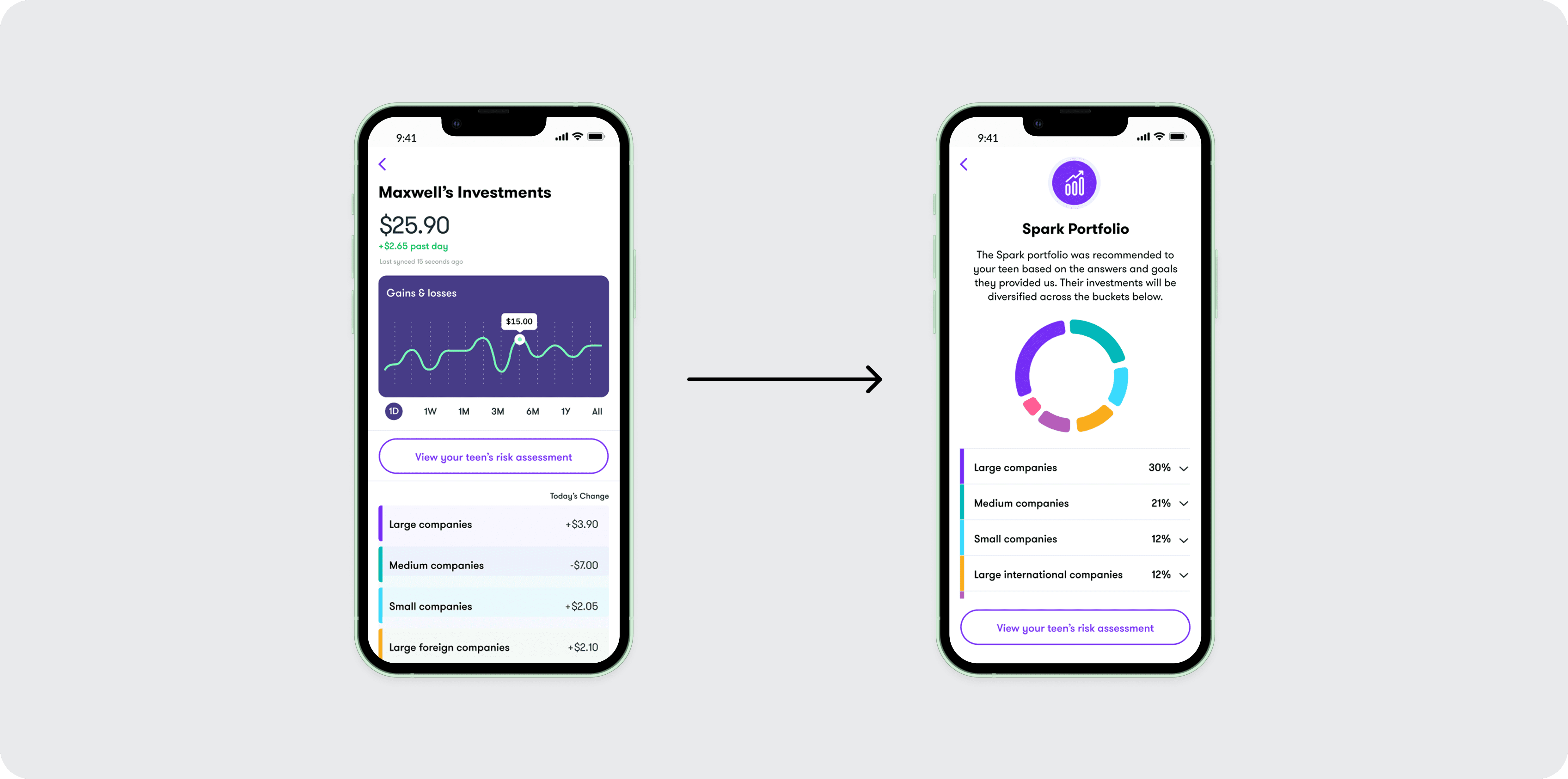

Reduced risk through auto-advised portfolios (we call them Lineups to be kid-friendly).

Reduced risk through auto-advised portfolios (we call them Lineups to be kid-friendly).

Rather than forcing teens to pick individual stocks, I introduced curated, diversified portfolios called "Lineups". This reduced risk and decision fatigue while offering an intuitive entry into investing.

Rather than forcing teens to pick individual stocks, I introduced curated, diversified portfolios called "Lineups". This reduced risk and decision fatigue while offering an intuitive entry into investing.

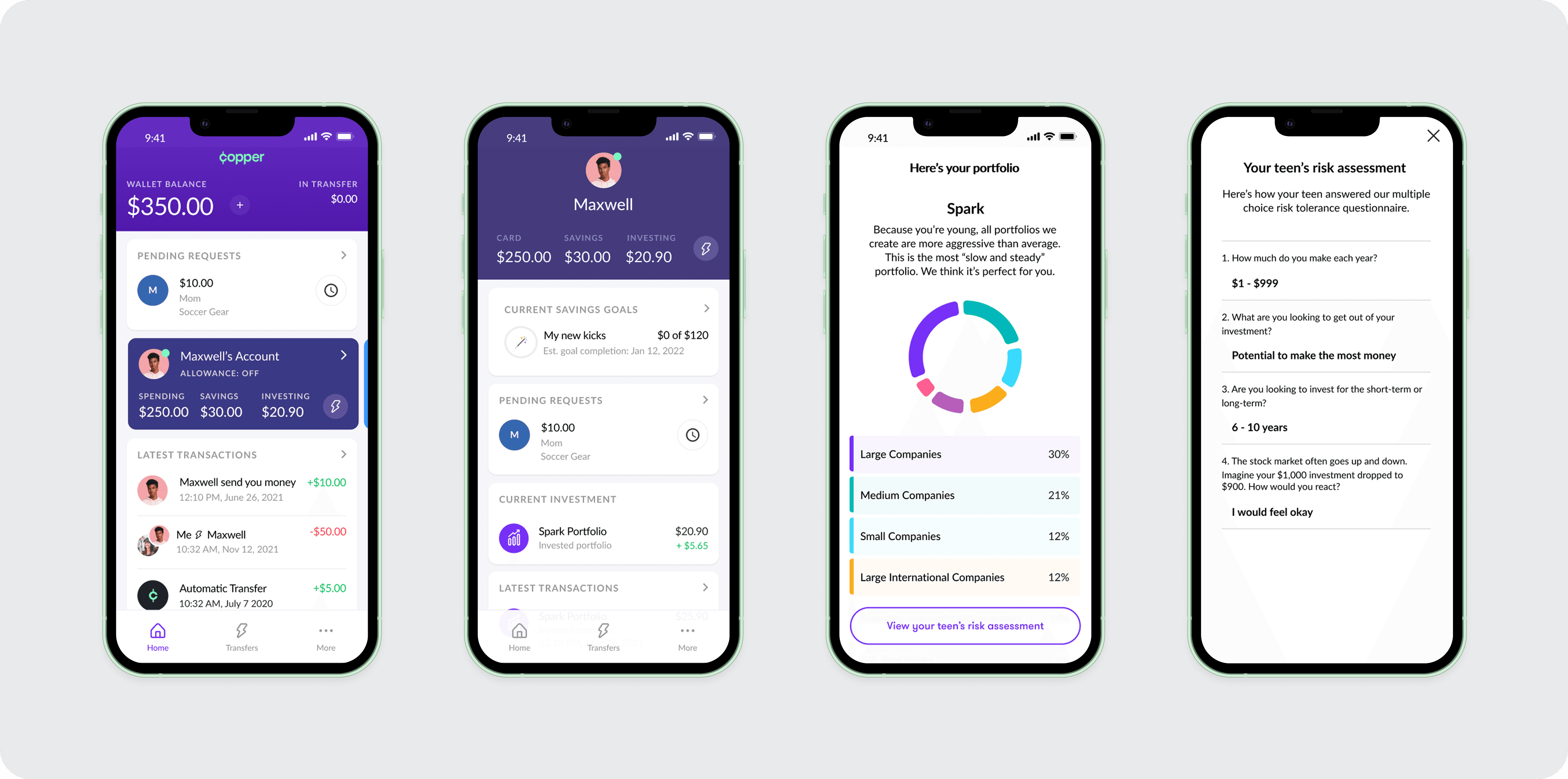

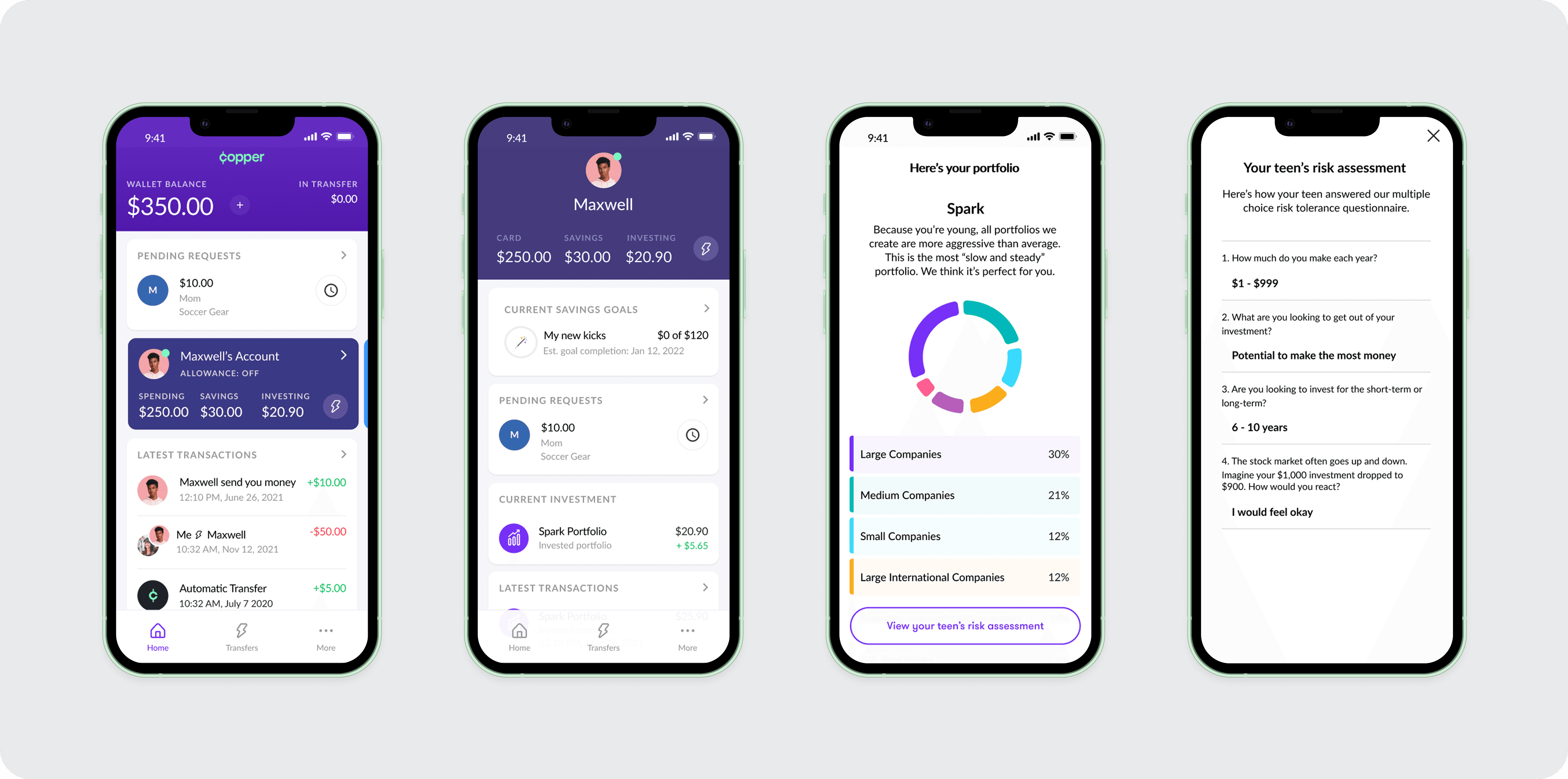

We showed parents what their teen built for their Lineup, but without undermining teen autonomy.

We showed parents what their teen built for their Lineup, but without undermining teen autonomy.

Parents could approve once and then monitor ongoing investments, providing visibility and peace of mind without undermining teen autonomy.

Breaking down the walls between design, engineering, and marketing

Breaking down the walls between design, engineering, and marketing

I collaborated closely with engineering and product leadership to align on technical constraints and delivery priorities, and ran iterative usability tests with teens to validate design decisions. Regular cross-functional reviews ensured clarity and alignment across teams.

Engineering cut scope on parent experience

While working closely with engineering, we found that building fully custom investing preferences for parents would significantly increase scope and complexity. I made a deliberate trade-off to reduce engineering effort while still meeting parent needs by designing a view-only experience. This allowed parents to clearly see their teen’s Lineup, understand account performance, and receive warnings when investments showed signs of risk.

Copper Banking is now repositioned as a complete financial product, encompassing savings, peer-to-peer transfers, and investing.

Copper Banking is now repositioned as a complete financial product, encompassing savings, peer-to-peer transfers, and investing.

Teenagers spent more time learning how to invest, improving confidence, and building their Lineups. This new feature also spiked more engagement on other feature of the product, including creating savings goals and increased signups on debit cards. The investing experience led to a new subscription plan for parents.

This project became a model for how Copper approaches complex product design, marrying craft with measurable business impact while navigating nuanced user needs across demographics. I led the UX vision and execution, influencing product culture and design rigor beyond this feature.

Wins and outcomes

The investing product launch was a success. We had 450,000 new accounts created within the first month of release. 87% of our teenagers converted to full banking customers after setting up investor accounts. We awarded $50,000 worth of free stocks during the investing waitlist. Due to the success of the investing product, we secured $29M in Series A funding.

“This is the first investing app that feels like it's for me. I can’t believe I am already growing wealth and I'm only 16!"

Tom A.

Teen investor

“As a parent, I am grateful for this product. My daughter is loving her Lineup and learning so much about investing.”

Steffani R.

Parent

Want to see more?

To see my work and design process in more detail, view the full case study or contact me for an interview.