Overview

Copper Banking is an early-stage fintech startup offering a teen-first digital banking app to help families teach financial literacy, manage allowances, and encourage safe spending. With a strong foundation in banking and savings, it was time to expand into investing.

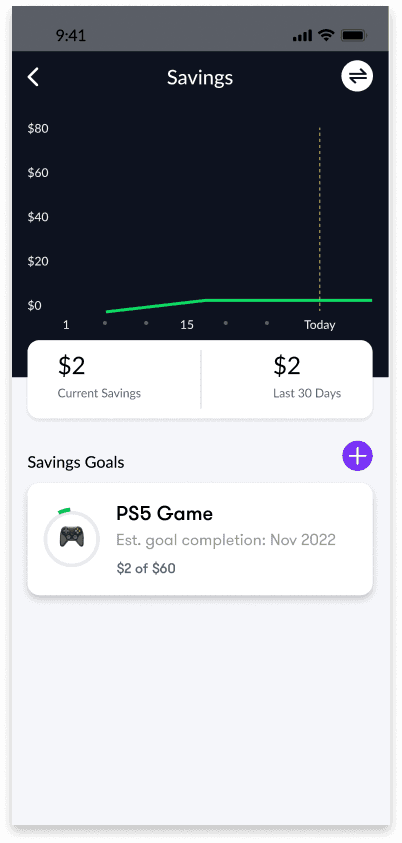

Fewer than 30% of the 300,000 teenagers had savings goals, and of those who did, 15% actually reached them. We had a real product opportunity in our hands. We could drive more product engagement, increase peer-to-peer transfers, and increase our revenue through transaction fees.

+85%

+72%

92,000

Problem area

Teenagers can’t afford big ticket items because they don’t know how to save money

Many teenagers earn money through chores or allowances, but one teenager set an ambitious goal of buying a car at 16 and saved for years, only to feel discouraged as it became unattainable. This highlighted the need to start with smaller, achievable goals that build confidence and momentum over time.

I need to help teens start with smaller, achievable goals to build confidence and reinforce positive financial habits, making larger, long-term goals feel attainable over time.

Design goals

What I aimed to achieve

Design decision 01

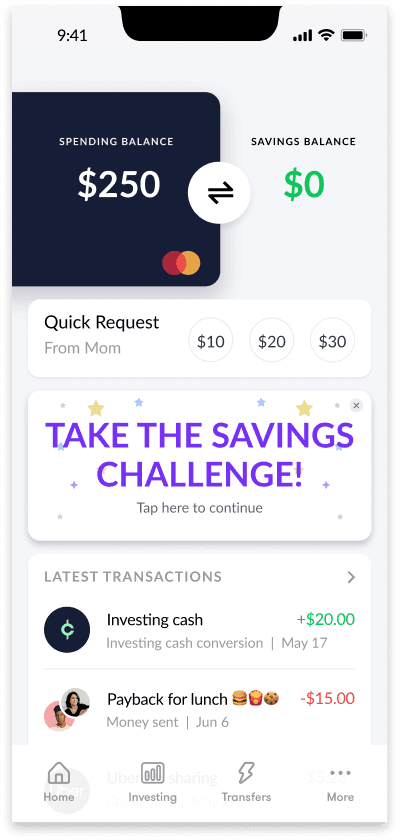

Gamify goal setting with a Savings Challenge

While creating goals was easy, many teens lacked a basic understanding of why and how to save. I introduced a Savings Challenge with short, bite-sized lessons and quizzes to teach saving fundamentals, reinforce retention, and intentionally slow teenagers down so they engaged with the material rather than rushing through it just to earn the $2.00 reward toward their first goal.

The Savings Challenge is always accessible for quick access to education

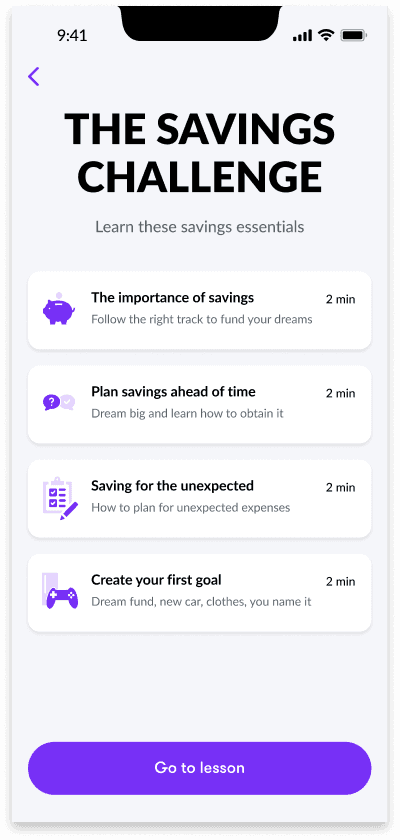

Design decision 02

Teenagers earned money towards their first goal

An early survey helped define the incentive for the Savings Challenge by revealing that the biggest barrier to creating savings goals was a lack of money. I partnered with leadership and marketing to secure additional funding and introduce a cash incentive, awarding $2.00 to each teenager who completed the Savings Challenge.

Providing cash incentives...and maybe a little confetti for completing the Savings Challenge

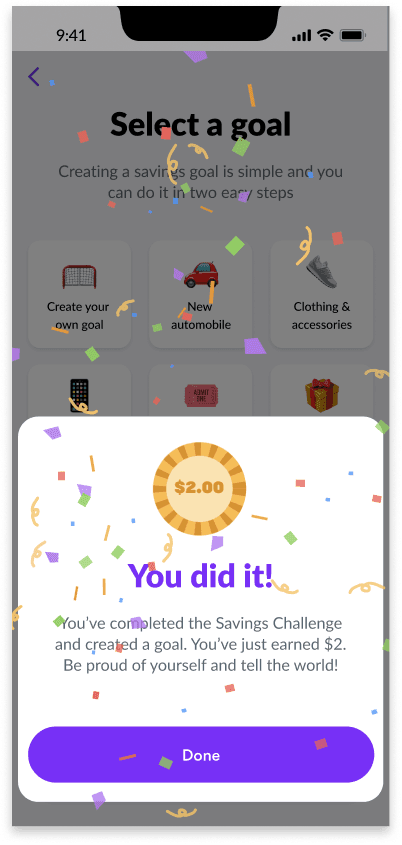

Design decision 03

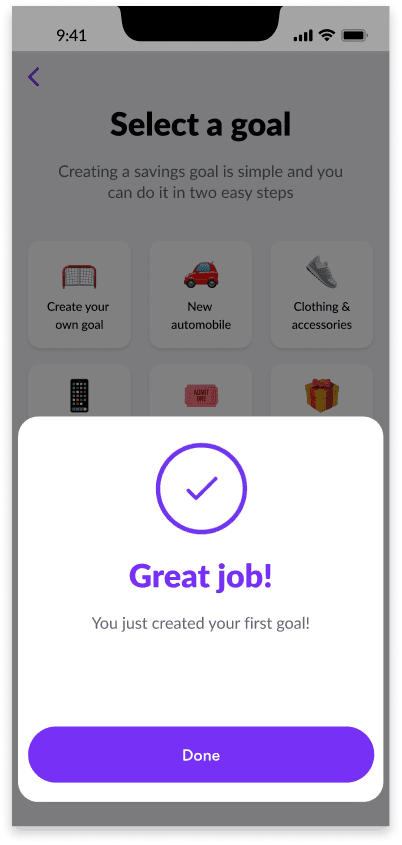

Include setting up a first goal as part of the Savings Challenge

After testing the experience with teenagers, I identified a pattern where many skipped creating a first goal and instead transferred their earned cash directly to their checking account. To address this, I made “create your first goal” the final step of the Savings Challenge, guiding teens to transfer their earned cash directly into their first savings goal.

Setting up a savings goal is as simple as 2 steps

Retrospective

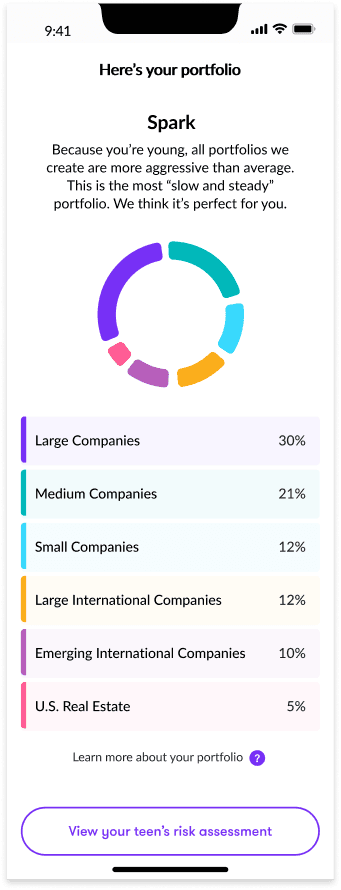

How one feature became a system for earning rewards

I transformed the Savings Challenge into a reusable education template that scaled across Copper Banking, from investing lessons to entrepreneurship and micro-business courses. This repeatable model drove higher engagement across the product, increased inter-account money transfers and debit card usage, and directly contributed to revenue growth.

“Before Copper, saving felt pointless because I never knew what I was saving for. The Savings Challenge helped me understand how money actually grows, and setting my first goal made it feel real.”

Samantha K.

Copper Banking user

“Shawn led the Savings initiative with a rare balance of user empathy and business rigor. By grounding decisions in research and validating solutions through testing, he turned a simple savings feature into a scalable education platform that drove measurable engagement, increased money movement, and unlocked new revenue opportunities across the product.”

Jacob E.

CPO, Copper Banking

Impact